One thing that’s given me a lot of mileage in my career is my ability to work out of CRMs.

For many industrial companies, this is still a massive struggle. I’ve seen and worked with too many companies that have whiffed on the transition from opaque information on Excel spreadsheets to clarity on their revenue operation.

It’s not really anybody’s fault. Tech companies dump extensive systems in your lap. You don’t know how to work it. You put your IT guy on the case. He can certainly work in and around the platform but isn’t always business-minded enough to know what he should be creating for you.

Your marketing is no different when it comes to CRMs. For industrial companies pouring money into a CRM for the first time, the ability to have clarity on the effectiveness of your marketing is a major advantage to making smart decisions.

But where do you start?

This is where marketers and executives in manufacturing fall woefully short. Focused a lot on the content or the campaign and less on the conversion paths and the sales funnel. If executives want to truly see how effective their marketing is, and if marketers ever want to progress out of the marketing manager position to the director or VP level, your game in a sales CRM will need to raise up.

Fortunately, I’m here to guide you on just this challenge. While everyone has a variety of names for this (marketing-sales alignment, revenue operations, sales enablement, etc.), what it boils down to is understanding the mechanics of your sales motion and how marketing contributes to it.

Understand that, and then you’re able to back out the data and create real goals and key performance indicators for yourself.

I usually break this down into three parts:

- Conversion paths (literally, forms)

- Reporting and dashboards

- Sales opportunity mechanics

Mastering these will give you a substantial leg up on your peers most of the time.

Conversion paths

As an executive, something to keep in mind as you scrutinize or ask questions about your marketing:

Not all form submissions are created equal.

Why? Well, a quote request or contact us submission will always hold higher sales-intent value than an ebook form or webinar registration.

Two of those forms show a willingness to talk to a member of your organization, the others are people trying to educate themselves — partially about you but partially about a topic they feel deficient in.

Have empathy for that.

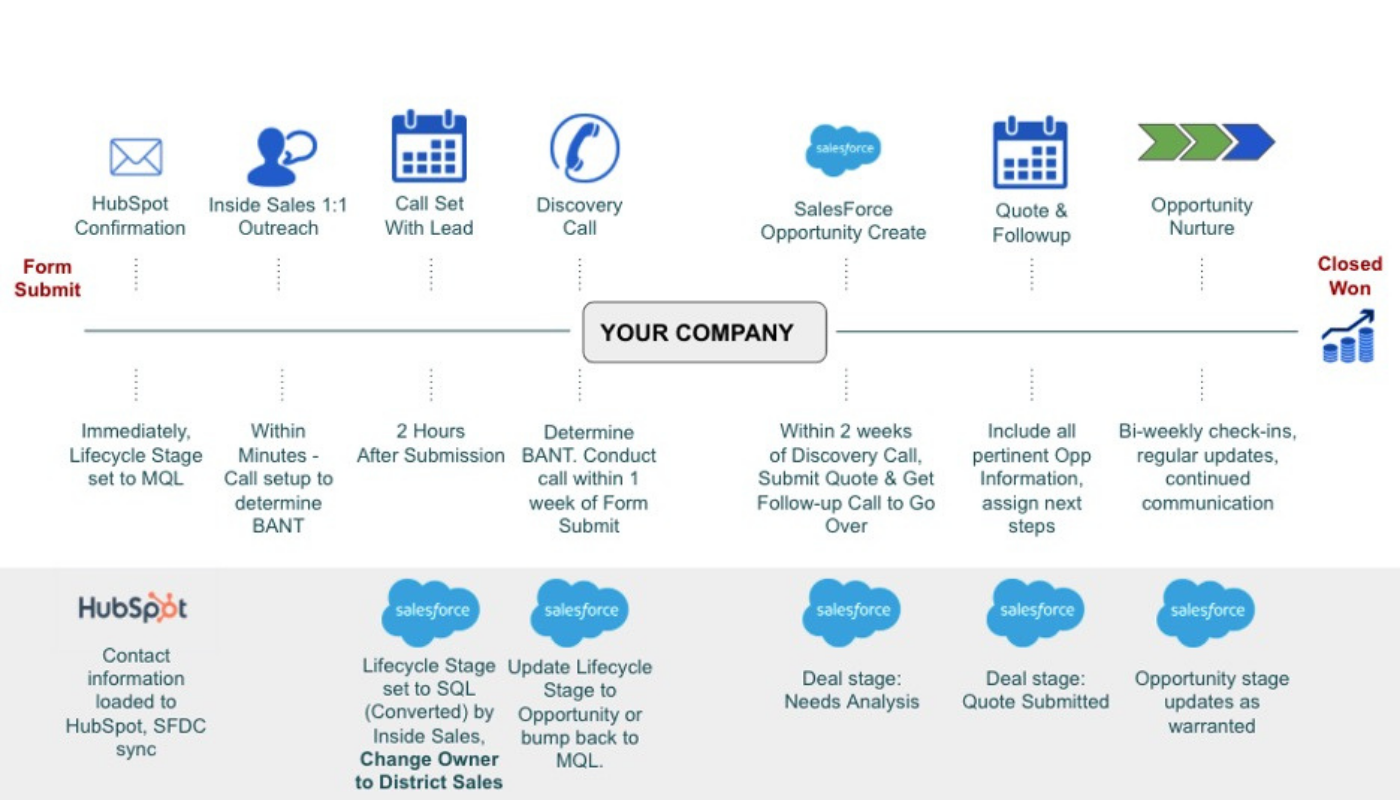

I want to focus on the sales-intent conversions. Here is normally the motion I see companies go through:

Production manager completes a quote form, asking about how your solution might fit on their line. Marketing passes it off to your territory rep. Your territory rep is in Salina, Kansas all day doing an installation or a presentation. Internet connection is non-existent. He sees the request come through when he gets back to his hotel at 6 p.m. Fires off a well intentioned but late email some seven hours later. And the person forgot they even asked for a quote in the first place.

This is one of those friction-killing scenarios I’ve watched play out my entire career.

It doesn’t have to be this way.

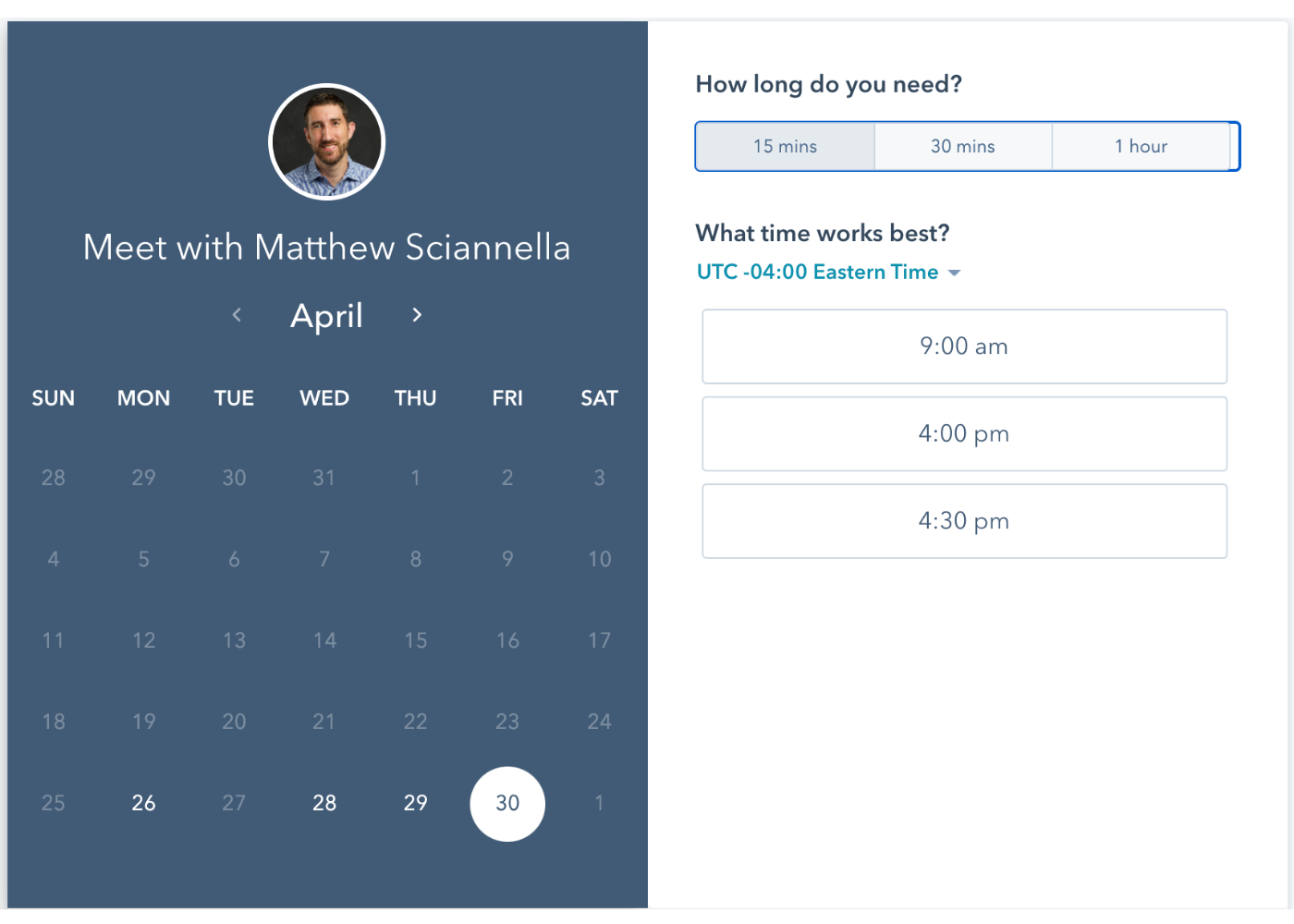

As a marketer, you need to own this as well. You should not allow more than an hour to pass before a 1-to-1 follow-up on a high-intent conversion. Ideally, you would even use a calendar app to let a prospect book time with you to discuss their specific needs.

That’s not a one-size-fits-all approach, however. Consider how consultative your sales process is. The more consultative and customized, the better a fit you are for a calendar booking tool.

That’s not a one-size-fits-all approach, however. Consider how consultative your sales process is. The more consultative and customized, the better a fit you are for a calendar booking tool.

Here are the questions that need to be asked and answered in regards to conversion paths:

- What happens after a person fills out the form?

- Who owns it?

- What does follow-up look like?

- What is the follow-up timeline?

- What are next steps after follow-up?

- What’s the criteria for moving them to sales-qualified?

- When does a qualified lead become an opportunity?

Document this stuff for your marketing and sales team. This should be part of any service level agreement your revenue team makes.

You should know who is getting assigned the lead and what they are supposed to be doing upon assignment.

Have command over this, because this has consequences down the line as you get into reporting. Each of these three steps are made to build upon one another.

Reporting and dashboards

Too many marketers struggle with reporting, and largely it’s because they try to make a mountain out of molehill.

Go for simplicity in your reports and dashboards. You likely only need to show your executive team about four or five reports to demonstrate your impact on the business. The rest can be qualitative. After all, you’re telling the story of your marketing’s impact, not just the data.

With that said, understanding the reports your executive team is looking at from a revenue standpoint will be a massive help to help you align your marketing strategy to their overall goals.

It’s the same if you are an agency. Align to the revenue goal, and let the goal drive the strategy and then the tactics.

Dave Gerhardt calls this the GST Framework — goals, strategy, tactics.

If you have not operated out of a sales CRM before (a la SalesForce), here’s a few things you need to identify quickly and why:

- What data is being collected on the executive dashboards? Why?

- What does pipeline and closed won look like last month/quarter/year?

- What is the marketing- and sales-sourced breakdown of said pipeline?

- What does the close rate look like marketing- vs. sales-sourced?

- What does marketing-sourced pipeline look like split by conversion?

- How many quote (or demo) requests have you gotten the last 12 months? How many turned to deals?

- What is the breakdown of direct/organic/paid opportunities?

There’s a lot to unpack here so I’ll start high level and work down.

The data collection is important because it deserves scrutiny. You should also identify in this reporting what marketing filters your executive team uses (i.e., deal source, etc.).

Scrutinize this. If they’re only collecting, for instance, website leads when you could segment further, you should provide that feedback and do a review of that data to get more granular insights.

Pipeline is self-explanatory, but let me state you should look at pipeline in a variety of ways to serve as a baseline and to help set KPIs. You should be breaking out pipeline by month, quarter and year so you can see where the marketing-sourced pipeline has been and where you need to be.

One month’s prior data doesn’t tell the story. One quarter prior doesn’t either. Not even one year! In totality, they all give you a barometer of where you should be aiming based on your company’s desired growth rate.

I would look at a month back to see how it stacked up with the lag of marketing activities. A quarter’s worth of data will tell you how a campaign has or is performing (or multiple campaigns), and a year tells you how the program as a whole is doing. Divide that year up by 12 and by four see how it aligns to your last month and last quarter. This will give you a good idea of where you need to prioritize things.

Close rates are where expectation setting takes place. Again, this largely depends on your organization:

- Are you distributor-focused?

- Do you have inside sales?

- Full-cycle sales?

- Is full-cycle sales in-house or remote?

All of these will impact positively and negatively close rates, along with a variety of other factors, such as the criteria by which you log opportunities and progress them through the funnel.

Split close rates by marketing- and sales-sourced. This will tell you what expectation to set for your executive team. If you see a large disparity between marketing- and sales-sourced close rates, dig deeper to see why that is happening. Is it a lack of resources on your end? Poor campaign management? Poor sales motion follow up? Is your strategy all wrong? This is something there’s no magic potion for, but scrutinize, ask questions and try new things to get a lift.

I look at sales intent conversion over everything else. Demo requests, quote requests, free trials and even contact us forms to me all hold higher value over a content download or a webinar registration. And that’s because that person is raising their hand and wanting to be contacted by your sales team (or wanting to use your product).

So track these against non-intent conversions. This is a process called splitting the funnel, and it’s eye-opening to see how high intent leads progress versus low intent. Look at the high intent conversions and track them using a funnel dashboard to see how many of those form submissions became deals versus content downloads.

You’ll probably see a multiple greater efficiency tracking those high intent conversions through. That will inform your efforts greatly moving forward and tell you where to prioritize. But it’s also a baseline to let you know how many of those high intent conversions you need to produce the revenue metrics you’re scored on.

For instance, if you produce 12 quote requests per month, take 25% into an opportunity, and close 40% of those opportunities, this is what you’ll need to produce to hit a marketing-sourced revenue goal of $1 million if your product on average is $75,000:

- 12 quote requests per month = 144 per year

- 25% on average to deal = 36 marketing-sourced deals per year

- 40% on average close rate = 14 deals closed per year

- $75k average deal amount = $1.05 million per year marketing-sourced revenue

Track this in your reports. Dashboard this. Make sure your executive team has visibility on it.

And for gosh sakes, manage up here. Have command over what’s happening and be able to explain courses of action for when things aren’t firing on all cylinders and ways to pour gas on it when it is.

Master your sales CRM, and you can master your marketing metrics.

Knowing the breakdown of direct vs. organic vs. paid is simply a way to look at where to place bets. It’s not a teller of the entire story, however. Paid ads — be it Facebook, LinkedIn or YouTube — all influence revenue in direct and organic channels. It simply isn’t something that attribution can cleanly capture.

My suggestion is to do a simple line chart showing the amount spent in paid ads with the amount of pipeline generated. There should be correlation there within six months. But clean attribution isn’t something I recommend striving for or you’ll be biased towards decisions that may not serve your interest long term. Pay per click and paid social are completely different animals in intent and execution. In truth, you need both and an organic content arm.

Sales opportunity mechanics

You may be shocked to hear this, but not every company has a great grip on their sales process.

Most reps hate SalesForce. Most reps don’t update it. Most reps don’t know or care about why things need to be logged or documented the way they are.

But you don’t have to fall victim to that if you don’t want to.

I like to understand the mechanics of a sales opportunity because it helps me understand how to market to a prospect before they ever are in an opportunity in the first place.

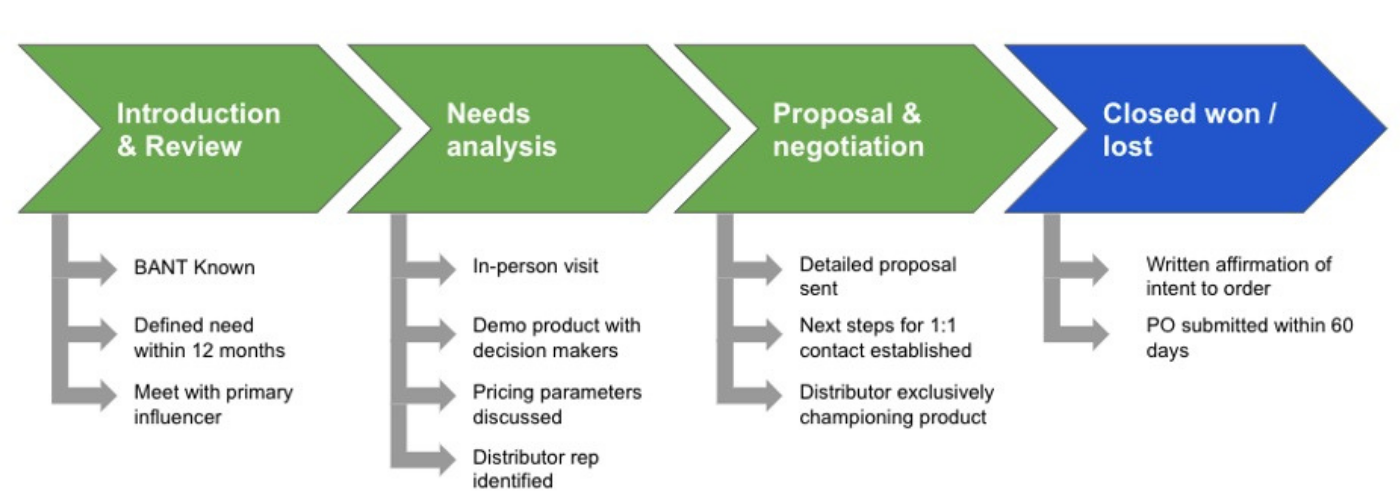

What you want to understand more than anything is the following:

- What does each deal stage represent in the sales process?

- What are the exit criteria from one stage to the next?

- How are stage progressions documented?

If you sell multiple products or have multiple product lines with distinct ideal customer profiles, getting this information at a more granular level is even more important.

One thing I recommend doing here if you have time is looking at each stage of the deal by product group if necessary and clearly defining with your sales team what exactly moves a deal from one stage to the next.

If, for instance, they need BANT (budget, authority, need, timing) known before doing an in-person visit, then you can help to establish that in the quote process — either directly on the form or in between the quote request and quote submittal via a follow up to establish some of those key pieces of information.

You can also frankly allow for your content to educate a prospect so ensure that a majority of prospects who come through meet that BANT requirement. That would mean writing content around pricing if you don’t have a pricing page already, discussing lead times very clearly and crafting a “who we help and how” page that will help weed out bad fit clients.

All that makes sure your lead flow and that first sales motion is more productive than not.

Why knowing the sales CRM matters

This is all about commanding authority and building trust and relationships with your peers. It’s easy to make content, run campaigns and stack low-intent leads without giving thought about where that translates downstream with revenue.

The difference between being in that leadership position with your marketing and constantly taking a backseat to sales is knowing how your efforts translate to revenue.

Without being able to command the sales CRM to tell the story of your efforts, you’ll be spinning your marketing wheels forever and not allow your program to take that next step toward getting more personnel, increasing budget and working as a revenue team with sales hand in hand.

Now go get that SalesForce license and start making it happen.

Ready for marketing to produce a real business impact?

If your sales CRM can’t capture a lick of your marketing’s impact on the bottom line, you my friend are not alone.

It’s simply a matter of knowing what metrics matter and which don’t. And trust me, there’s a lot of marketing metrics that don’t matter. At all.

And some of them are from the same marketing tech vendors that have been brainwashing you for years.

Want the truth served cold? Consider a Road Map with the Gorilla team. We start with a front-end content strategy and build the demand generation engine on the back of it, building your company’s brand and getting that marketing-sourced revenue engine purring.

And if you want, contact me anytime on LinkedIn. Happy to talk and dish on marketing and your business. It’s what I love to do!

Finish strong in the meantime.